In 2024, with the continuous enrichment and increase of market trading strategies, and the wave of international politics and interest disparities, the volatility of gold and the Japanese yen has also shown significant fluctuations. In this environment, we will find that more and more retailers are conflicting with investors, generally involving trading violations. One of the major reasons for this conflict is that retailers lack liquidity or cannot fully meet the frequency of investor strategies, resulting in a large number of sliding points or even negative values, which is the least desirable situation for industry development.

As a leading global liquidity provider, Alpha Trade provides ample liquidity services to retail institutions and high-quality customers in the market through partnerships with dozens of banks, investment banks, and non banking institutions. For some special strategies and trading varieties, we still customize a tailored liquidity plan through the combination and optimization of liquidity plans, providing the most practical guarantee for customer profitability.

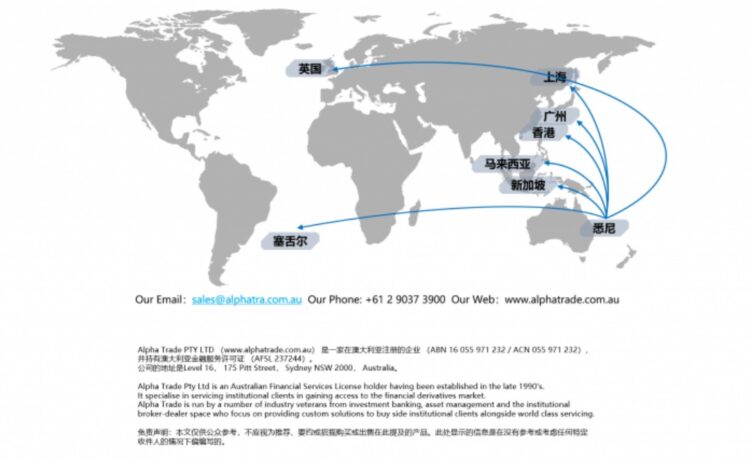

And because we are located in data centers in important financial cities around the world, we have always been able to provide customers with stable and fast quotations. Thanks to our good market depth, we can also serve market customers with huge transaction volumes well, allowing them to better gain their market share.

The expertise of Alpha Trade will undoubtedly bring another technological revolution to the Asian region, achieving more professional level investment clients and obtaining substantial returns in the market.